-

Latest

12 August 2025

AnnouncementChange in Director's Information of the Manager

Relevant

4 September 2025

InvestmentsFull investment portfolio of Relevant Investments at 31...

Movement in Units

31 August 2025Monthly Return on Movements in Units -

Portfolio

LEARN MORE -

Leasing Enquiries

LEARN MORE

FAQ

1. What is Sunlight REIT?

2. Who is Henderson Sunlight Asset Management Limited?

3. What is the Trust Deed?

4. Who is the Trustee?

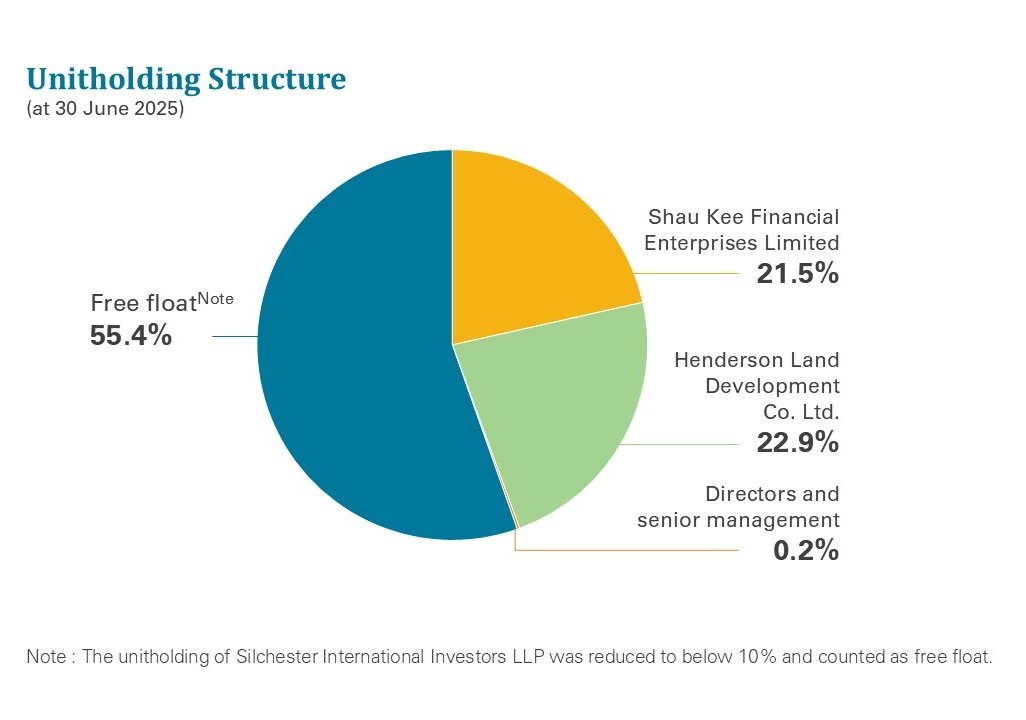

5. What is the unitholding structure of Sunlight REIT?

6. What is Sunlight REIT's proportion of ownership of each of the properties?

7. What are the benefits that Sunlight REIT will bring to its unitholders?

8. Can Sunlight REIT sell its properties?

9. Can Sunlight REIT acquire more properties?

10. What are the acquisition criteria in selecting properties to be included in the portfolio in the future?

11. Will Sunlight REIT acquire overseas properties?

12. Who handles leasing and property management functions for Sunlight REIT's portfolio?

13. Are there any plans to renovate and improve the property portfolio?

14. What is the leasing policy and strategy of the Manager?

15. What is the distribution policy of Sunlight REIT?

16. What is Annual Distributable Income?

17. How often will Sunlight REIT pay its distribution?

18. How does the Manager seek to enhance the value of the portfolio?

Sunlight REIT is a Hong Kong collective investment scheme authorised under the Securities and Futures Ordinance and offers investors the opportunity to invest in a diversified property portfolio comprising 17 office and retail properties in Hong Kong. The Grade A and B office properties are located in both core and decentralised business areas, while its retail properties are located strategically in regional transportation hubs, new towns and other urban areas with high population density (click here for location map).

Who is Henderson Sunlight Asset Management Limited?

Henderson Sunlight Asset Management Limited, an indirect wholly-owned subsidiary of Henderson Land Development Company Limited, is the Manager of Sunlight REIT.

The Manager's primary responsibility is to manage Sunlight REIT and the property portfolio in the sole interest of the unitholders in accordance with the Trust Deed. It will establish the investment and strategic direction as well as risk management policies of Sunlight REIT, and will manage the assets of Sunlight REIT in accordance with such strategy and policies.

The Manager is also responsible for ensuring compliance with the REIT Code and the Trust Deed, as well as applicable provisions of the Securities and Futures Ordinance, the Listing Rules and all other relevant legislations and regulations. The Manager also deals with all regular communications with unitholders in relation to Sunlight REIT.

What is Sunlight REIT's proportion of ownership of each of the properties?

Nine of the seventeen properties owned by Sunlight REIT represent effectively the entire interest in the land for the leasehold term under the Government land grant. Three other properties owned by Sunlight REIT represent effectively the entire commercial accommodation of the development concerned, and all the related car parks.

For other properties in the portfolio, the parts owned by Sunlight REIT represent either the majority or a minority proportion of the undivided share interests of the whole building/development, coupled with the right to exclusive possession over the relevant part of the commercial units within the building/development.

What are the benefits that Sunlight REIT will bring to its unitholders?

Unitholders have the opportunity to invest in:

- A portfolio comprising office properties which are strategically located in both core and decentralised business areas as well as retail properties in densely populated areas experiencing rapid population growth.

- A diversified portfolio of office and retail properties:

- Diversified across the office and retail segments in Hong Kong, including Grade A and Grade B offices in both core and decentralised business areas, as well as regional shopping centres and quality street-level shops.

- Diversified geographically throughout Hong Kong Island, Kowloon and the New Territories.

- Diversified tenant base across its retail and office properties, which span a wide range of end user business segments and exhibit low tenant concentration.

Can Sunlight REIT sell its properties?

The Manager has a long-term investment objective. However, it will regularly review the medium to long term attractiveness of individual properties within Sunlight REIT's portfolio as part of its active portfolio management strategy. The REIT Code requires investment properties to be held for a minimum of two years unless the sale is approved by unitholders by way of special resolution.

Can Sunlight REIT acquire more properties?

Yes. The Manager will actively seek to identify, evaluate and selectively acquire income-producing investment properties under a disciplined and objective investment methodology aimed at evaluating opportunities which have the potential to provide attractive total returns to unitholders through:

- Accretion to distribution yield; and/or

- Sustainable growth in distributions; and/or

- Long-term enhancement in value of the portfolio.

What are the acquisition criteria in selecting properties to be included in the portfolio in the future?

The Manager's investment criteria include, but not limited to :

- Competitive advantages of the properties including location, occupancy and tenant characteristics, access to infrastructure including major roads, public transportation and amenities and services, demographic developments and relevant government initiatives;

- Ability to add medium to long-term value through employing its active operational management and asset enhancement strategy; and

- Quality of the building and facilities specifications.

Will Sunlight REIT acquire overseas properties?

The Manager intends to focus on office and retail properties primarily in Hong Kong, and may also make acquisitions of other commercial properties, including industrial/office properties and car parks located elsewhere, which meet its investment criteria.

Who handles leasing and property management functions for Sunlight REIT's portfolio?

Under the Property Management Agreement, the Manager has delegated to Henderson Sunlight Property Management Limited, Property Manager an indirectly wholly owned subsidiary of Henderson Land Development Company Limited, for providing property management and leasing services for the property portfolio of Sunlight REIT. The Property Manager will operate under the overall management and supervision of the Manager.

Are there any plans to renovate and improve the property portfolio?

The Manager works closely with the Property Manager to improve the rental income and value of the portfolio by undertaking asset enhancement activities, such as improving lettable efficiency and rental potential through space rationalisation, reconfiguration and building facilities upgrade.

What is the leasing policy and strategy of the Manager?

The Manager aims to employ a flexible leasing strategy that capitalises on the general economic cycle, supply and demand dynamics and the demographic characteristics around the properties.

The Manager works closely with the Property Manager to actively evaluate the leasing and marketing strategies for the portfolio aimed at maintaining strong relationships with existing tenants and leveraging the competitive strengths of the individual properties, for example structuring leases with turnover rent or pre-determined rent escalation provisions.

What is the distribution policy of Sunlight REIT?

Starting from the financial year commencing on 1 July 2010, the Manager's distribution policy is to distribute to unitholders an amount not less than 90% of Sunlight REIT's Annual Distributable Income for each financial year. Such policy is consistent with the requirements under the Trust Deed and the REIT Code. For further details, please refer to the announcement dated 1 June 2010.

What is Annual Distributable Income?

Annual Distributable Income means the amount calculated by the Manager as representing the consolidated audited net profit after tax of Sunlight REIT and each company wholly-owned by the Trustee on trust for and on behalf of Sunlight REIT for the relevant financial year, adjusted to eliminate the effects of certain non-cash items and adjustments which have been recorded in the income statement for the relevant financial year.

How does the Manager seek to enhance the value of the portfolio?

The Manager intends to optimise the performance and enhance the overall quality of the portfolio through various business and investment strategies:

- Active operational management and asset enhancement strategy: Active operational management and asset enhancement initiatives to improve the long-term value of the portfolio.

- Investment and acquisition growth strategy: Identify, evaluate and acquire income-producing investment properties which have the potential to contribute to sustainable growth in distributions by Sunlight REIT and long-term enhancement in value of the portfolio.

- Capital management strategy: Efficient capital management framework to support the Manager's operational and acquisition growth strategies.

- Business management strategy: Build and sustain a quality work force, as well as sound corporate governance practices, systems and infrastructure to support the Manager's asset management activities.