-

Latest

12 August 2025

AnnouncementChange in Director's Information of the Manager

Relevant

4 September 2025

InvestmentsFull investment portfolio of Relevant Investments at 31...

Movement in Units

31 August 2025Monthly Return on Movements in Units -

Portfolio

LEARN MORE -

Leasing Enquiries

LEARN MORE

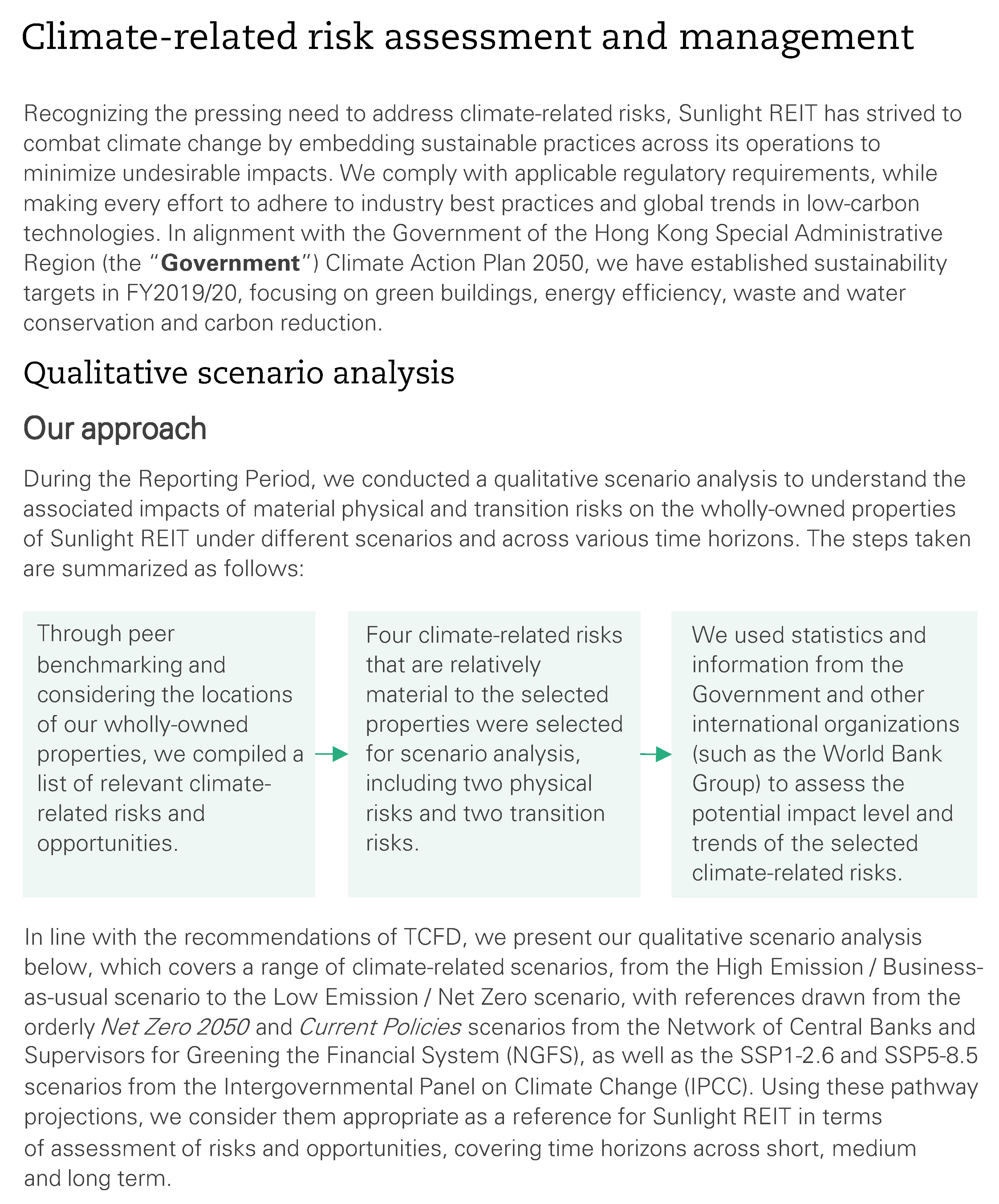

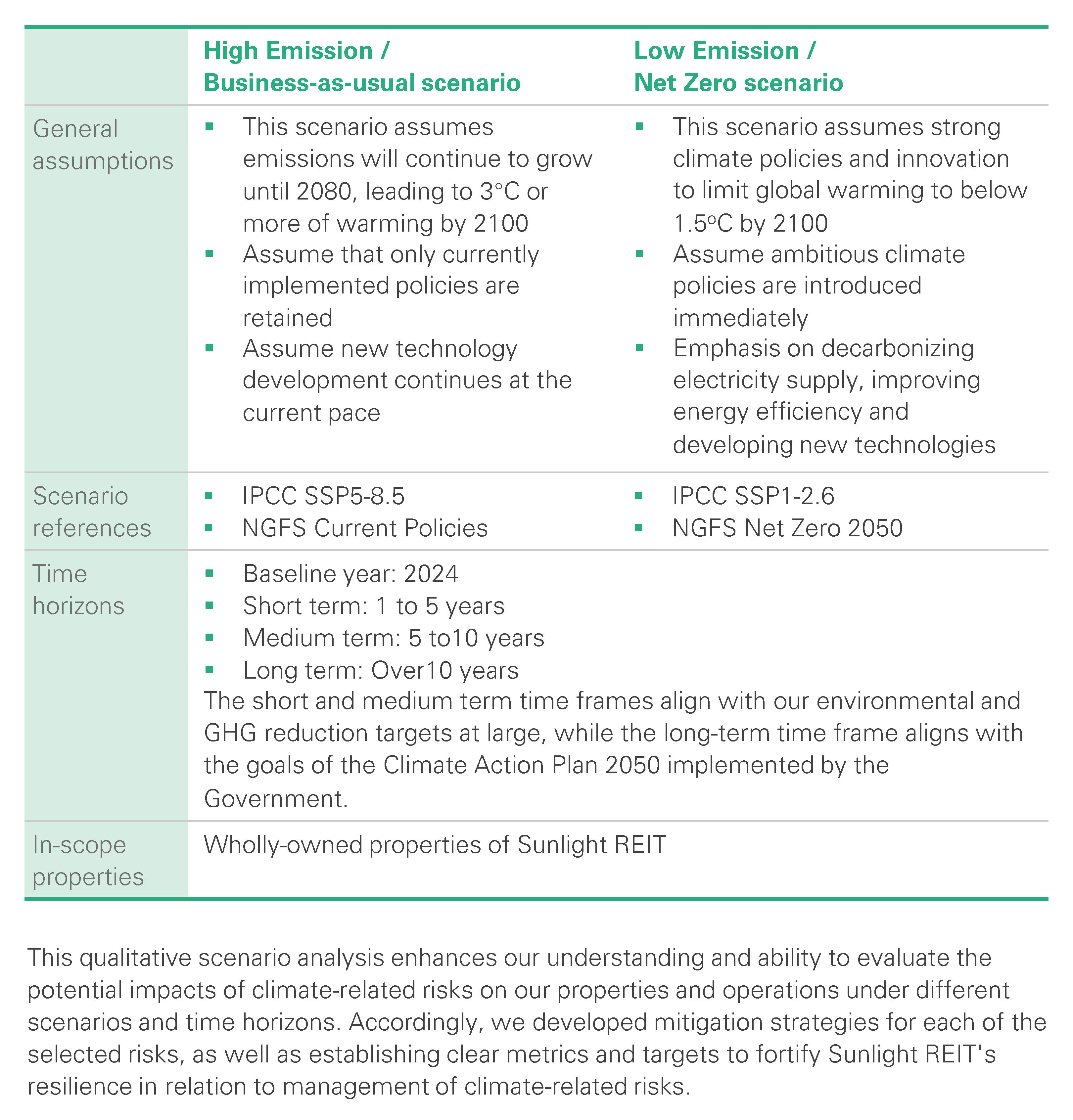

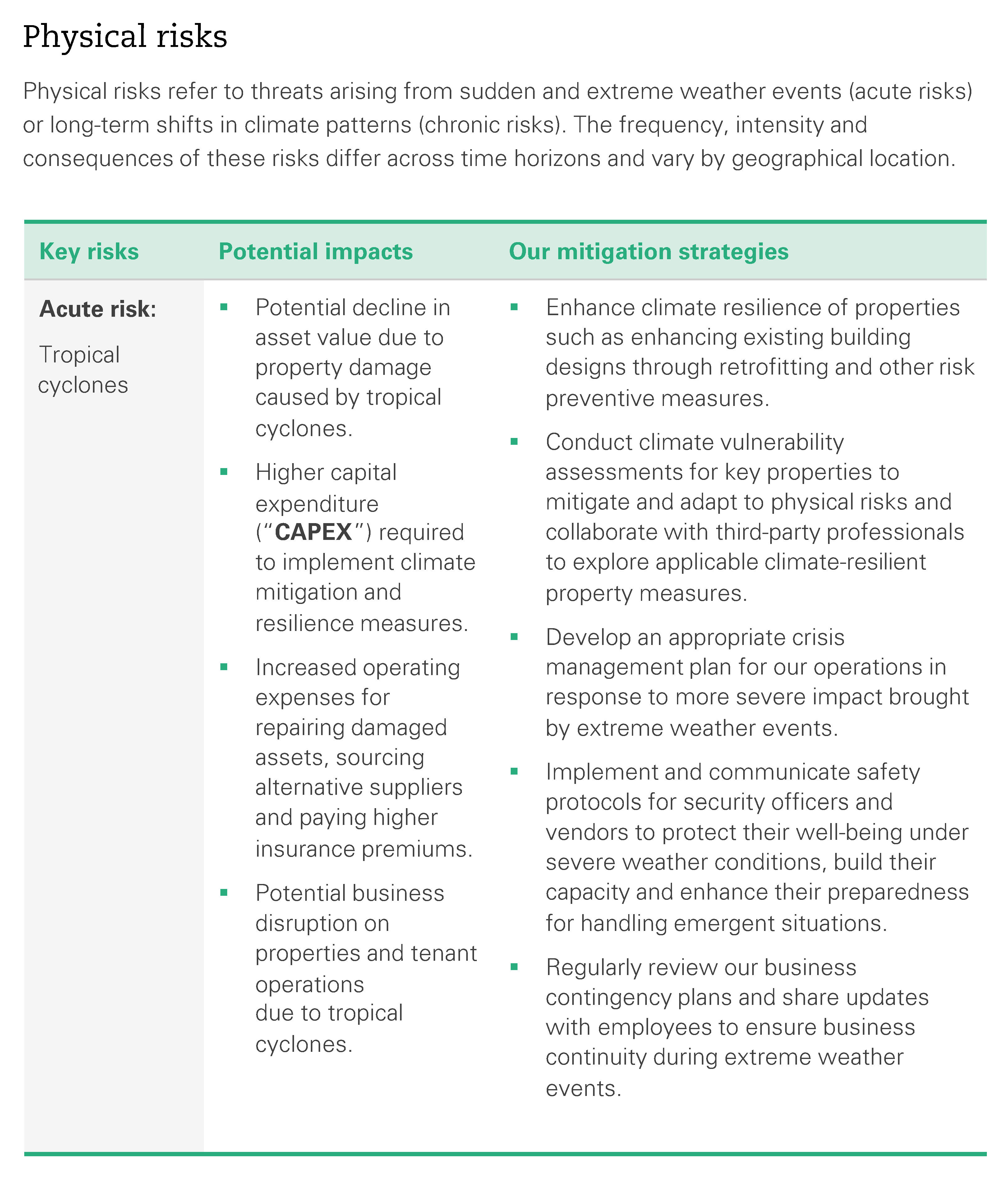

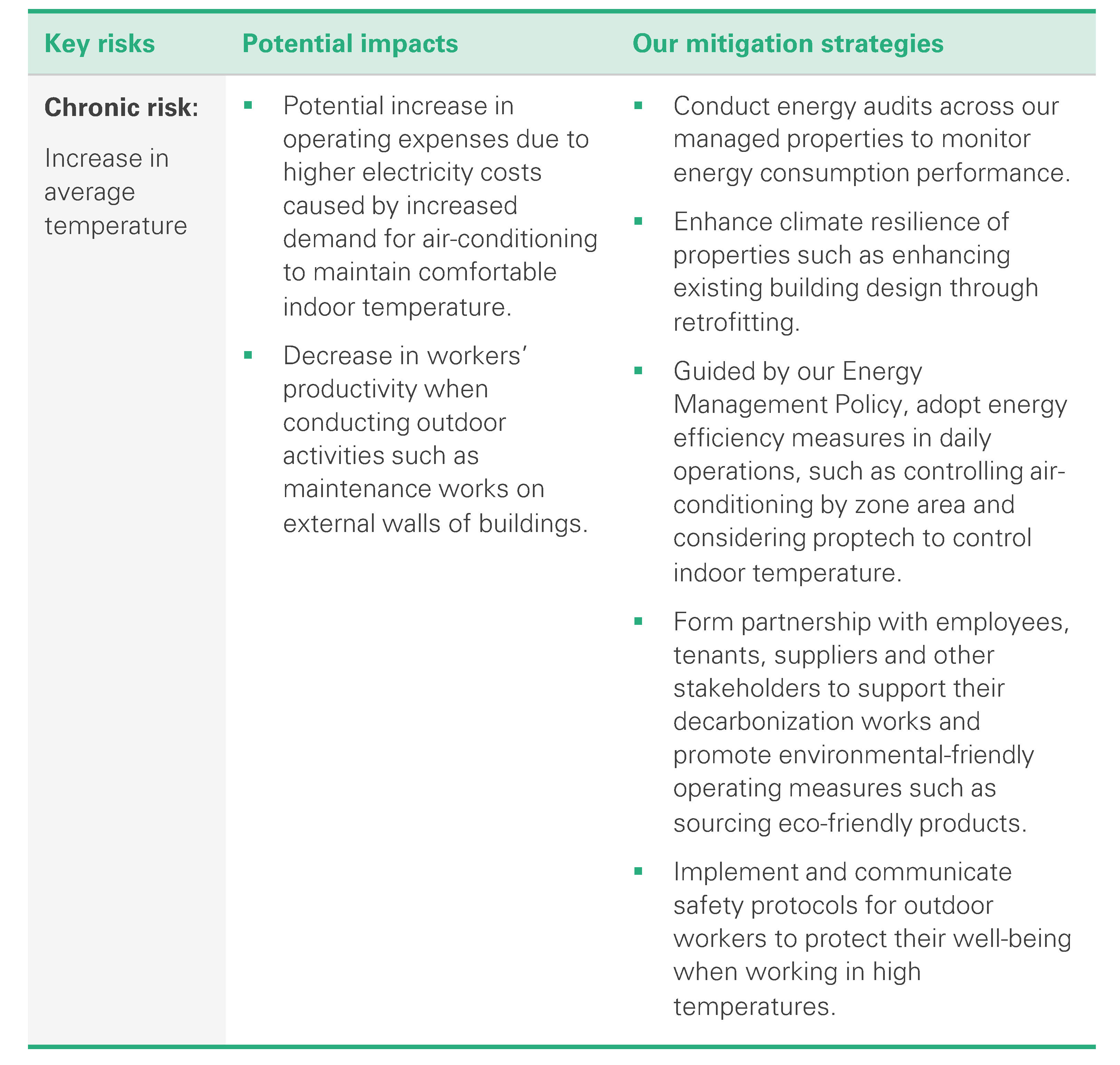

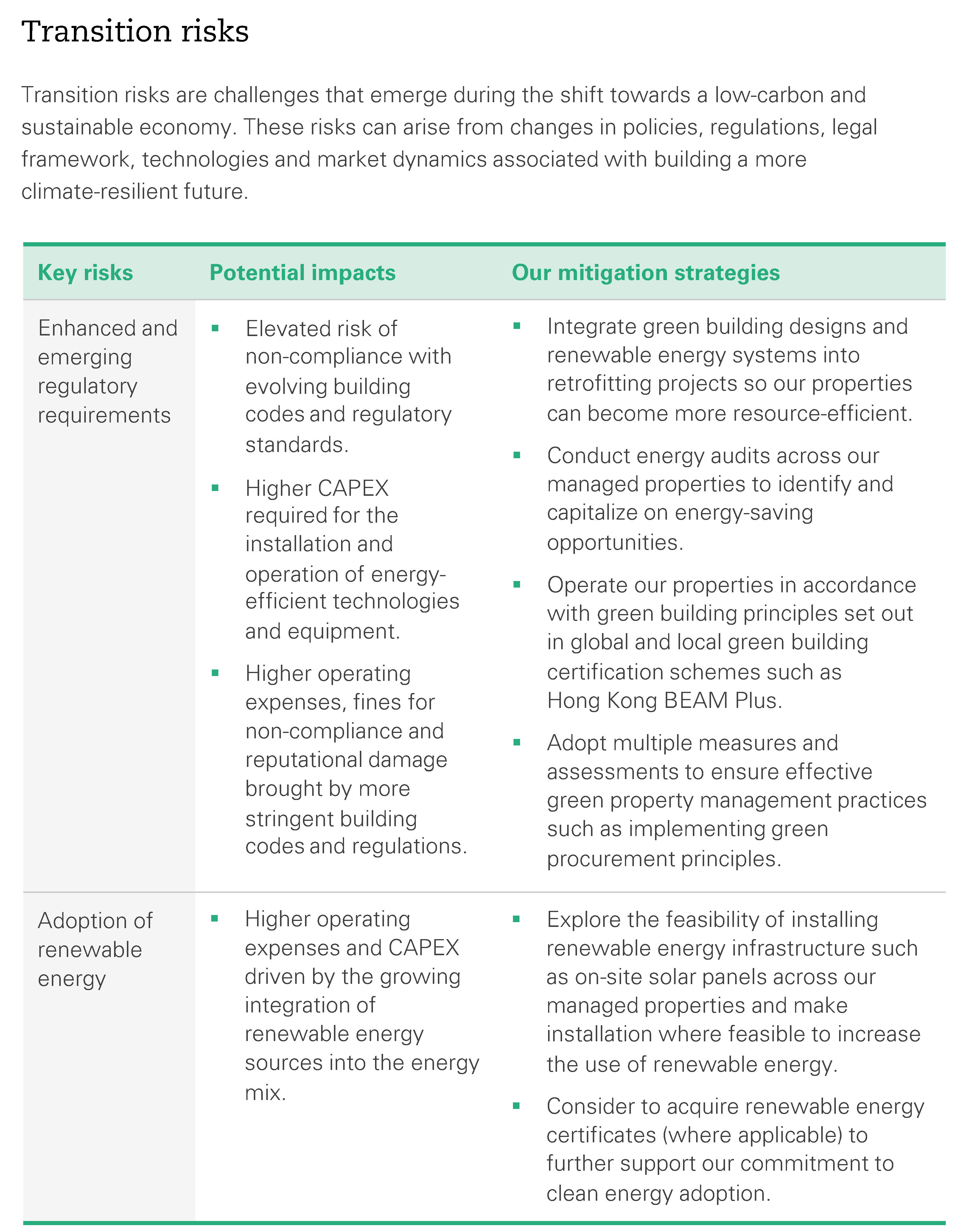

Climate Change

Assessment of Climate-Related Risks

The Manager adopts a blended approach in Sunlight REIT’s risk management framework which effectively harnesses the merits of both top-down and bottom-up approaches in identifying risks.

The ESG Committee monitors sustainability risks (including climate-related risks) and makes recommendations to the Risk Taskforce on a semi-annual basis. Further, pursuant to SFC’s circular in relation to “Management and disclosure of climate-related risks by fund managers” dated 20 August 2021, the Manager is required to assess climate-related risks of Sunlight REIT at least annually. Based on the recommendation from the ESG Committee, the Risk Taskforce considers that climate-related risks are relevant but not material to Sunlight REIT during the Reporting Period.

Please refer to the “Risk Management” section under Corporate Governance of Sunlight REIT’s website.